2023 Mid-Year

HOUSING FORECAST

By: J. Lennox Scott | Chairman and CEO

If you or any of your friends are thinking of moving, please reach out for a personal market consultation or if you have any questions about the market.

In real estate, it is all about the supply and demand principle. In the current housing market environment, in the more affordable and mid-price ranges where 80% of transactions are occurring, we are observing a virtually sold-out market.

This year, new resale listings are coming on the market at a rate of 25% to 35% below normal seasonal levels. We are experiencing frenzy sales activity intensity™ of new resale listings going under contract within the first 30 days, with many multiple offer situations and premium pricing. We forecast this frenzy market will continue in these price ranges throughout 2024.

SHORTAGE OF PROPERTIES FOR SALE

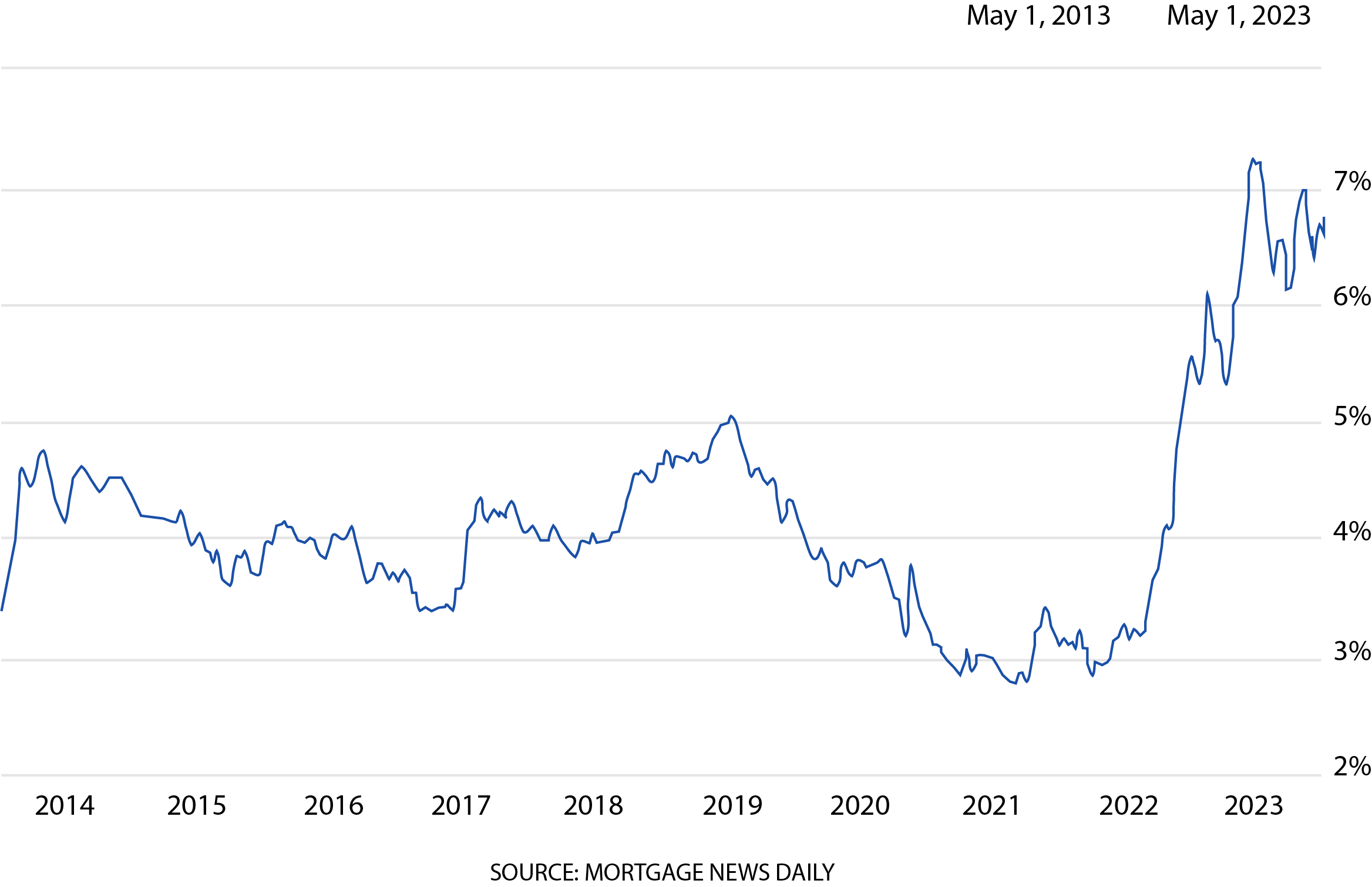

With inflation, we typically experience higher interest rates for mortgages which generally leads to a slow-down in the market causing home prices to decline. This did happen in 2022 as home prices adjusted from the spring spike, but in 2023, we are now once again experiencing price increases in the more affordable and mid-price ranges.

Homes are not coming onto the market in the normal sequence, many homeowners refinanced during the pandemic when the rates were at all-time lows, and they aren’t ready to sell and purchase at a higher interest rate, which is contributing to fewer new properties coming on the market.

UNIQUE HOUSING MARKET

Pending and sold numbers are down which is mainly due to homeowners staying put. With the low supply of inventory and the buyer demand in the more affordable and mid-price ranges, home prices are heading higher.

The best selection and availability for homes in these price ranges will remain through October. As we head into the late fall and winter, we experience a seasonal drop of new listings coming on the market, starting in November until March 2024. Prices are expected to increase with buyer demand as we enter 2024. Normally, September is the high point for unsold inventory, but this year, we will be experiencing a shortage of supply.

PRICES ARE HEADING HIGHER IN THE MORE AFFORDABLE AND MID-PRICE RANGES

In today’s normal or healthy market, we typically experience 25% to 35% of homes going under contract in the first 30 days. Due to the unique housing market conditions, approximately 65% of homes are going under contract in the first 30 days at the price points where 80% of sales activity takes place. In these price ranges, prices are heading higher as we expect that new listing inventory will run below the typical rate through 2024 and most likely, over the years ahead.

What is a Normal or Healthy Market?

Most sellers today fall into two major categories: life events and homeowners with equity. Life events include job transfers and family household formation changes. Homeowners with large equity such as retirees, seniors and those who have been in their homes for five or more years are also a big driver in today’s housing market. This large equity group is mainly downsizing, moving closer to family, moving for health reasons, or to a lifestyle/destination market. With 50% to 100% equity in their current homes, this group of sellers are on the move.

WHO IS SELLING AND MOVING IN TODAY’S MARKET

For luxury buyers, there is a good selection, good pricing, and good opportunity. In 2022, the luxury market had high appreciation in the spring, but when the mortgage rates increased, multiple offers diminished, and the spring premium pricing came back off. For luxury sellers in 2023, there is healthy luxury sales activity in the upper end with selective buyer activity in the higher priced luxury market.

The Luxury Market

One of the main factors for today’s seller gridlock is today’s interest rates. However, there are opportunities to purchase a home today with a 2-1 buydown or 3-2-1 buydown offered by most lenders. Plus, homeowners can refinance at a minimum cost if/when the rates come back down.

Today’s Interest Rates

Coming off the Covid anomaly of infused liquidity for home mortgages and historically low-interest rates that we saw in the first half of 2022, appreciation levels decreased for homeowners in the second half of the year. However, with the unique housing market conditions we are experiencing, for 2023 we anticipate the median home price will end higher at the end of this year.

In the housing market, there will be ebbs and flows over the years and sometimes, within an individual year. But remember, it’s okay to buy and sell within same market timing at today’s price.

MEDIAN SALES PRICE AND HOME EQUITY

fr any friends are http://frenzy.jlsmidyearhousingforecast.com/p/1thinking of moving, give me a call and I will be glad to provide a personal market consultation.